参考资料

参考资料

参考资料

Moonshot回答

Generative models such as GAN, VAE, Flow-based models, and Diffusion models are being effectively applied to generate financial data for quantitative investment purposes in several ways:

-

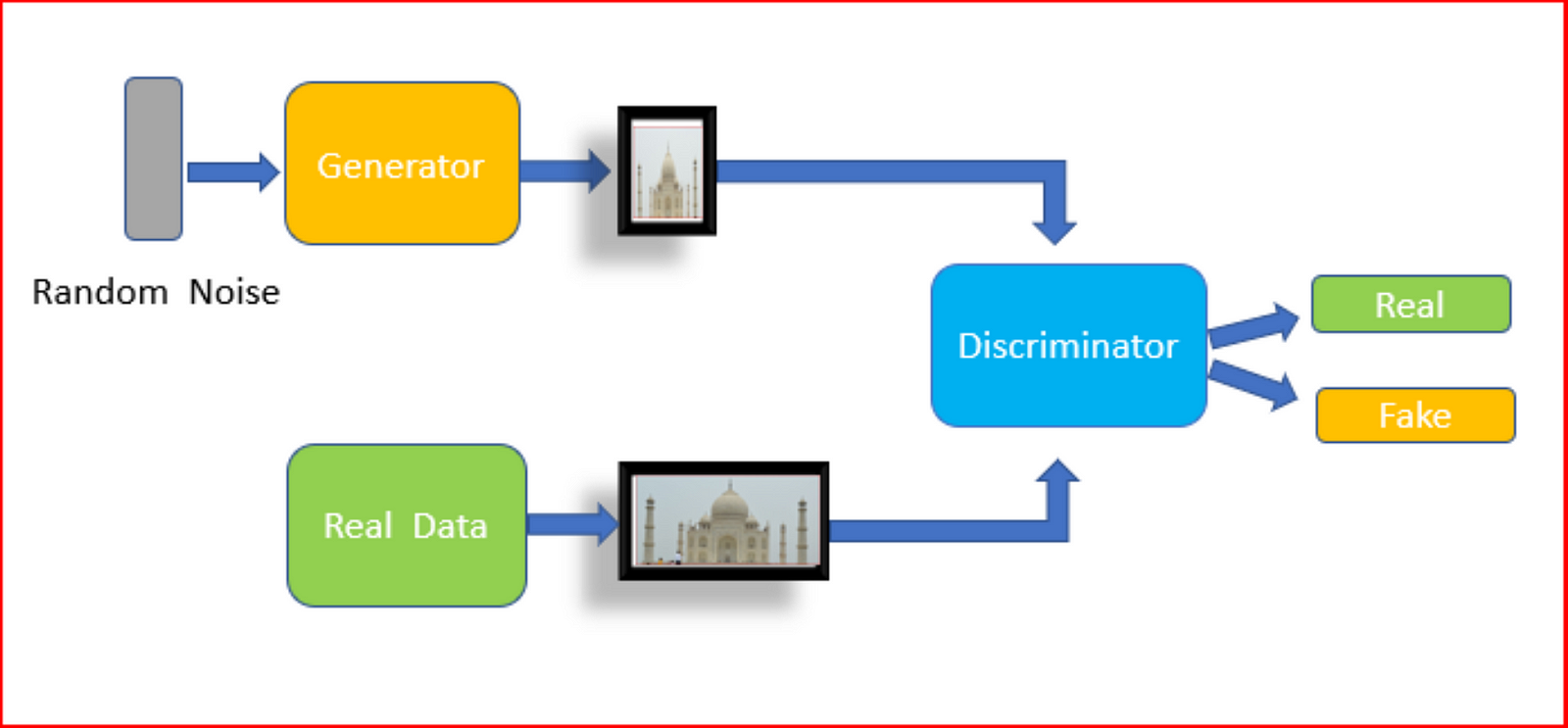

GANs are used to generate synthetic financial data that captures the statistical properties of real data, which can be used to augment the original dataset. They have been applied to financial time series data, such as daily S&P 500 Index values and FTSE 100 index values, to create new data with the same statistics as the training set.

-

VAEs are popular for generating synthetic data in the financial domain, addressing privacy concerns. They have been used to generate synthetic financial tabular data, with methods proposed to assess the impact of inputted tabular data on data synthesis.

-

Flow-based models, while not specifically mentioned in the search results, are known for their ability to model complex distributions and could be adapted for financial data generation, potentially offering a smooth and invertible transformation of data.

-

Diffusion models have been developed to generate real-world financial tabular data for regulatory tasks such as economic scenario modeling, stress tests, and fraud detection. FinDiff, a diffusion model, uses embedding encodings to model mixed modality financial data, including both categorical and numeric types.

These models are valuable for stress testing, backtesting trading strategies, and training machine learning models without risking exposure of sensitive financial data. They also help in creating synthetic datasets for model development and training, which can be particularly useful when real data is scarce or expensive to obtain.

继续提问

相关问题

antv/g6与svgedit比较,在图像编辑和显示方面有哪些差异和优缺点,请打分推荐

Mindset & Value Methodology在什么情况下能够帮助企业提高商业决策的有效性?

PowerSchool 在未来的并购和额外债务融资策略怎么影响公司的运营和市场表现?

流模型是如何通过双射关系实现数据生成的,为什么流模型在生成效果上没有显著优势?

奥托一世在第二次莱希菲尔德之战中采取了哪些关键战略?

在里克·贝克参与制作的电影中,有哪些电影是由迈克尔·杰克逊出演的?

武举考试与文科考试相比有哪些不同之处?

尹玉涵的昵称有哪些,这些昵称是如何与他的个人形象关联的?

巴巴里海盗是如何在海上捕获奴隶的?

《谁消灭了电动车》这部纪录片的反响如何,它对电动车技术的未来发展有何影响?