参考资料

Moonshot回答

To calculate FICA tax liability for 1099-MISC income, follow these steps:

-

Identify the Income: Recognize that 1099-MISC income is generally considered self-employment income. Source

-

Calculate Self-Employment Tax: Multiply your net profit by 92.35% and then by 15.3% to calculate your self-employment tax. Source

-

Determine the Taxable Amount: There is a limit to how much income is subject to Social Security and Medicare taxes. For 2024, the Social Security tax applies to the first $160,200 of your net earnings, and Medicare tax applies to your entire net earnings. Source

-

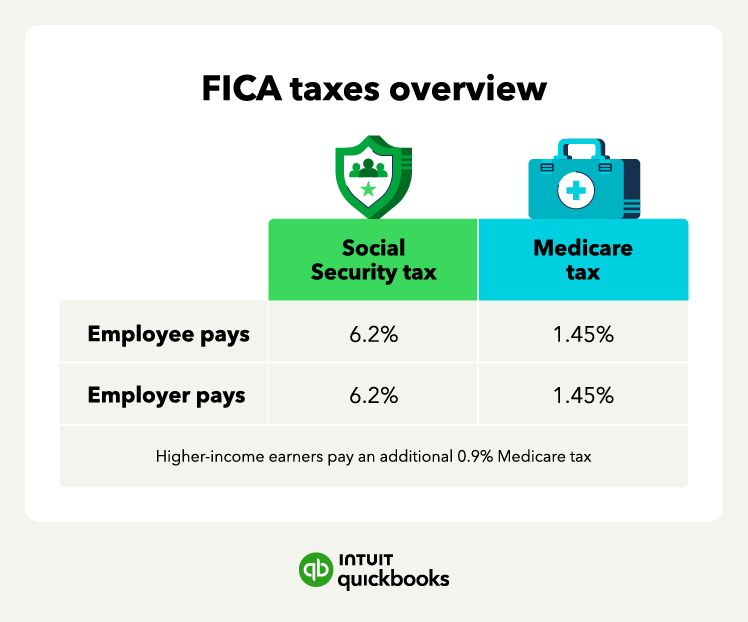

Calculate the Social Security and Medicare Tax: Multiply any earnings up to $160,200 by 12.4% (Social Security) and 2.9% (Medicare). For earnings over $160,200, only the Medicare tax of 2.9% applies. Source

-

Consider Additional Medicare Tax: If your earnings exceed $200,000, you may also need to pay an additional 0.9% Medicare tax. Source

-

Deduction for Self-Employment Tax: You can deduct 50% of the self-employment tax as an adjustment to income on your Form 1040. Source

-

Report the Income: Report the 1099-MISC income on a Schedule C or C-EZ to calculate your net profit from self-employment. Source

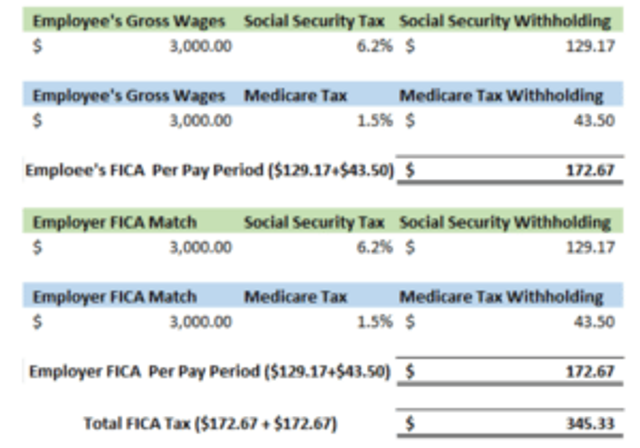

Here is an image that illustrates the FICA tax calculation process:

By following these steps and using the provided sources, you can accurately calculate your FICA tax liability for 1099-MISC income.